You must also have a loan provider that offers this as a service. Huge banks, like JPMorgan Chase, offer this service to their customers. However, they can choose to exclude certain loans from eligibility. For that reason, before making any big payment on your home mortgage with the goal of re-amortizing, you should contact your lending institution to identify if your loan meets their eligibility requirements.

The Department of Veterans Affairs loans are usually ineligible also. If you are a brand-new house owner who used one of these programs, you might be able to make a large payment versus your primary mortgage amount, however you will likely not have the ability to minimize your future home mortgage payments.

The key is finding a lender who wants to re-amortize your loans. Lenders aren't obligated to offer this service. Constantly keep up to date on property buying tricks prior to buying a home mortgage. When you initially start going shopping for your mortgage, ask your lender if they offer any re-amortizing choices and what scenarios you would be permitted to use them in.

Are you interested in purchasing or financing a home loan? We can help. Get a quote for our new home loan or refinancing choices today. Our knowledgeable and well-informed team can assist you determine what you receive and if you can benefit from those alternatives to move you're monthly financial obligations.

If you are looking for a mortgage in New Jersey, Pennsylvania, Delaware, Maryland, New York City, or Florida, please contact us today so that we can figure out the very best Home mortgage Lending institution to position your loan with and get you the best possible rate and program.

Putting extra money towards your mortgage doesn't change your payment unless you ask the lending institution to ... [+] recast your home mortgage. getty If you have additional money and are thinking about putting it towards paying for your mortgage early, you should know that it won't instantly reduce your payment. Putting extra cash towards your home mortgage does not alter your payment unless you ask the loan provider to modify your home loan.

8 Easy Facts About When Did Subprime Mortgages Start In 2005 Shown

Before putting a lump sum towards your home mortgage, understand your alternatives - who has the lowest apr for mortgages. Home loan recasting is when a lending institution re-amortizes timeshare warrior the loan after the property owner makes a large lump sum payment. In order for your payment to change, the loan should be reamortized to show the lower primary balance. Presume you buy a house and get a 30-year $500,000 loan at 3% interest.

In 5 years, you have additional money and decide to put $100,000 towards your mortgage. Without modifying your home mortgage, your payment stays the like the amortization schedule is still based on the initial $500,000 home mortgage, however the lump amount payment allows you to pay off the loan much faster: in about 22 years rather of 30 - the big short who took out mortgages.

Your brand-new month-to-month payment would be approximately $1,635, a savings of $465 monthly. Prior to making a big one-off payment on your loan, ask your lender if they're prepared to modify your home loan. The loan provider is not needed to do this, and some loans aren't eligible, so it might not be a choice.

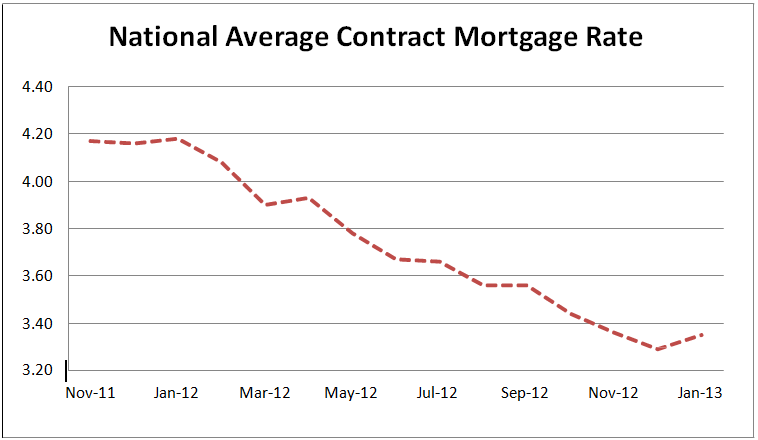

Home loan rates are currently very low. The average rate on a 30-year fixed home loan is 3. 06% as of the writing of this article. Depending on the interest rate on your existing mortgage, it may make more sense to re-finance your Go here loan instead of recasting it. This could allow you to minimize interest expenditure over the life of the loan and lower your regular monthly payment while utilizing the money for other investments.

If you have excess cash burning a hole in your pocket, think about the opportunity cost of paying down your mortgage early instead of using the funds to invest in other places. While you will minimize a portion of the interest expenditure, you might be better off investing the cash instead, especially if your interest rate is low.

If a property buyer can get a 30-year set home mortgage for 2. 85% and their long-term assumption for investment returns is 6%, they're utilizing leverage to attain a much better monetary outcome. After all, you will not delight in the benefits of paying for your home loan early till you're living debt-free, however the average buyer only resides in your home for ten years.

The Buzz on When Will Student Debt Pass Mortgages

Perhaps you have actually acquired money, saved vigilantly, or created a windfall by selling stock alternatives. Property owners who buy a brand-new home prior to selling their old home may also think about using the proceeds from the sale to pay down the new home loan. Once again, unless your lending institution accepts modify your home loan, it will not change your payment.

If you use the cash to pay for your loan, it's not easily offered if you need it for other goals and you have not enhanced your cash streams monthly without a home loan recast - hawaii reverse mortgages when the owner dies. Structure equity in your house is great, however you're currently doing so with each mortgage payment.

Last updated on August 18th, 2020 You might have heard that you can reduce your monthly mortgage payment without refinancing through a "home mortgage recast." These two financial tools are quite various, which I'll describe, but let's first talk about recasting to get a better understanding of how it works. In other words, a home loan recast takes your remaining home loan balance and divides it by the staying months of the mortgage term to adjust the monthly payment downwards (or upwards).

The downside to home mortgages is that the regular monthly payment does not drop if the balance is paid much faster. That's right, even if you pay more than essential, you'll still owe the very same quantity every month due to the fact that of the way home loans are computed. So if you made biweekly payments for an amount of time, or contributed one huge lump sum payment after some sort of windfall, you 'd still be forced to make the initial month-to-month payment until the loan was paid completely.

Initial loan quantity: $250,000Mortgage rates of interest: 4% Original month-to-month payment: $1,193. 54Current balance: $175,000 Let's assume you began out with a $250,000 loan quantity on a 30-year set home loan set at 4%. The monthly payment would be $1,193. 54. Now let's pretend after five years you came across some money and decided to pay the home mortgage balance to $175,000, despite the amortization of the loan dictating a balance of around $226,000 after 60 payments.

Although you owe a lot less than set up, you 'd still be on the hook for $1,193. 54 per month with the $175,000 balance. The upside is that the mortgage would be settled method ahead of schedule since http://johnnymesf210.iamarrows.com/how-common-are-principal-only-additional-payments-mortgages-can-be-fun-for-anyone those fixed monthly payments would satisfy the lower balance before the term ended.

The Main Principles Of What Is The Best Rate For Mortgages

That's where the home loan recast enters play. You make a large lump amount payment toward your home mortgage (there's typically a minimum quantity) It is applied to your outstanding loan balance immediatelyYour bank/servicer reamortizes your loan based upon the lowered balance, which decreases future paymentsUsually need to pay a cost for this serviceInstead of refinancing the home loan, you 'd just ask your present lending institution or loan servicer to recast your home loan.