This implies that you still need to pay real estate tax, preserve danger insurance and keep your house in great repair. If you fail to do so, the lender might establish that your finance has actually gone into default and your house can be subject to repossession. Your lending will certainly accumulate interest, and New Zealand reverse mortgage suppliers currently provide around 8% interest rates. Nevertheless, if home prices are raising over the time you have your reverse home loan, this may reduce your total loss in equity. If timed correctly, you may see minimal increases from passion when you settle the finance.

Our specialists have actually been aiding you grasp your money for over four decades. We consistently strive to give customers with the expert suggestions and devices needed to be successful throughout life's economic journey. Details provided on Forbes Advisor is for academic purposes just.

- You need to understand the reverse home mortgage downsides, including just how it will certainly place your residence at risk, as well as the advantages of a what is time share vacation reverse home mortgage.

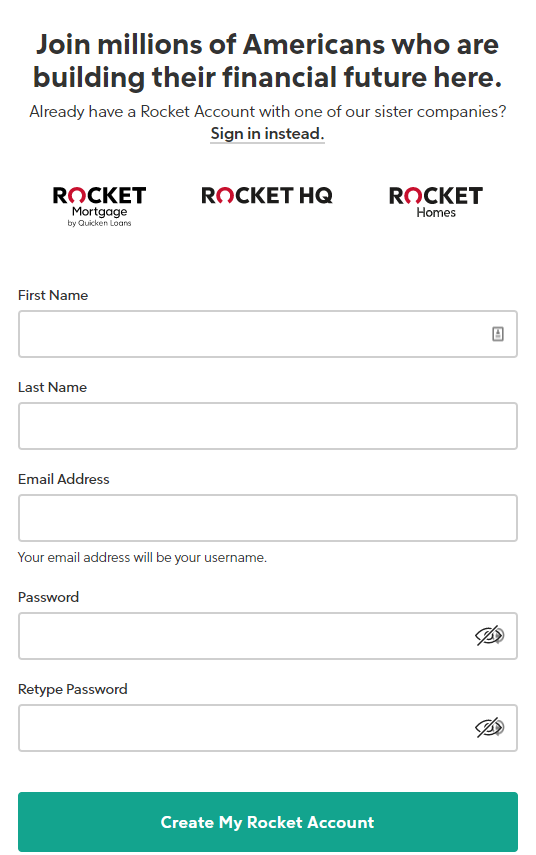

- Victoria Araj is a Section Editor for Rocket Mortgage and also held roles in mortgage financial, public relations and more in her 15+ years with the firm.

- In many cases, however, you'll be able to utilize the money for anything you want.

- Single-purpose reverse home loans are the least pricey choice.

- The financing profits are based upon the age of the youngest borrower or, if the customer is married, the more youthful partner, even if the more youthful spouse is not a debtor.

- If you're not sold on securing a reverse home loan, you have choices.

While we follow rigorous editorial honesty, this post may have referrals to products from our partners. Forbes Expert complies with strict editorial integrity requirements. To the very best of our understanding, all web content is precise as of the date posted, though deals had here may no longer be readily available. The viewpoints shared are the writer's alone and also have not been offered, accepted, or otherwise supported by our companions. Rate of interest charged is not insurance deductible up until it is actually paid, that is, at the end of the finance.

Reverse Home Mortgage Videos

A reverse home mortgage may restrict other funding choices secured by your residence. If both partners get Go to the website on the funding or one spouse is out the loan yet is an "qualified non-borrowing partner" then yes, either spouse can stay in the residence for life even after the various other spouse passes with a reverse home mortgage. The reverse mortgage provides a number of different choices to access the offered funds. Recognizing what you desire out of your reverse home loan will assist you choose the best choice to satisfy your long as well as short term objectives. So, she acquires her reverse home mortgage and-- after the expenses to acquire the funding-- has the exact same $200,000 credit line offered to her. If there are multiple borrowers, the age of the youngest customer will certainly reduce the quantity readily available since the terms enable all consumers to stay in the residence for the remainder of their lives without needing to make a repayment.

Retirement & Accounts

If your grandparents have their events in order, then the home possession would certainly experience probate as well as would pass to the successor according to their desires. If you are not sure if your residential property will meet the requirements, we can assess the specifications with you ahead of time and also give you an initial opinion of the outcome. A Quit Claim Act is not the very best method to transfer title to an additional specific as well as I do not understand if there may be others that also have any case to title. Component of the process for the lending would certainly be a title search and also if there was any kind of cloud on title, the title firm would not guarantee the title and also the lender would not provide the lending. You can outlast the funds if you draw all of them as well as there are no funds left to attract, however you can not outlast the lending. If rates of interest rise 1% in the third year as well as one more percent in the 7th, after two decades her offered credit line would be more than $820,000.

Our editors and reporters completely fact-check editorial content to ensure the info you read is exact. We keep a firewall software between our advertisers and also our content group. Our content group does not receive straight settlement from our marketers. Founded in 1976, Bankrate has a long performance history of helping people make clever financial selections. We've maintained this credibility for over four years by demystifying the financial decision-making procedure and giving individuals confidence in which actions to take following.

Reverse Home Mortgages: Just How They Function And Who Theyre Great For

Nevertheless, the consumer (or the debtor's estate) is generally not required to repay any additional funding balance in excess of the value of the house. Before also tackling the reverse home loan, Look at this website all customers obtaining a HECM reverse home loan need to undergo counseling from a UNITED STATE Division of Real Estate and also Urban Growth -accepted reverse home mortgage therapist. Counseling prices will vary, relying on the agency and also the debtor's certain scenarios. Other costs include source costs, shutting expenses, as well as home mortgage insurance coverage costs. You'll also need to pay servicing charges to the loan provider for prices such as sending account declarations, distributing car loan proceeds, and also making certain that you stay on par with the lending needs.

When you retire, you should not need to quit the home you love. Don't reply to unsolicited reverse mortgage deals by email or over the phone. Follow along as we discuss what a reverse mortgage is and also just how it functions. See today's home loan prices, determine what you can manage with our home loan calculatorbefore obtaining a mortgage. Reverse mortgages are most pricey in the very early years of the funding and also usually become less expensive over time.

You have the alternative to pay off the principal and rate of interest in full at any time. Nonetheless, you might have to pay a fee to pay off your reverse mortgage early. When none of the initial debtors are still staying in the residence, the finance comes to be due as well as payable during that time. You would not be able to "be included" to the existing finance and also there is no provision to think a reverse mortgage. You may pre-pay any portion you choose approximately and including the complete outstanding balance of the financing at any time scot-free. And your estate or your heirs can never ever owe greater than the residential or commercial property is worth.